Uniswap

Uniswap is an Automated Market Maker on Ethereum.

The core of Uniswap is constant product rule.

k = x * y

- x: The balance of asset A

- y: The balance of asset B

- k: The constant value

For example, we have 4 DAI and 4 USDC in a contract. If we want to take 2 USDC from it, we need to deposit 4 DAI so that the constant value k stays 16. In this case, the splippage is 2 DAI : 1 USDC.

As we can see, the rate is high. However, if the liqudity is deep, e.g. 1000 DAI and 1000 USDC, the slippage of taking out 2 USDC is going to be 1.04 DAI : 1 USDC. In conclusion, the liqudity is important in AAM.

Impermanent loss

Liquidity providers in Uniswap earn passive income, however, the exchange rate of the underlying assets will have changeds. This raises the possibility of impermanent loss.

Impermanent loss is the oppotunity loss. It's possible that the providers earn more if they don't put the assets in Uniswap pool.

Router contracts

If the asset A and B are not tradable, and A/C, B/C are. We still can trade A/B. Router contracts help to find the best path to trade assets.

Drawback

Front running

It's a drawback of AAM and Proof of Work. The miner can see all the pending transactions, and choose which one to run first.

Arbitrage

Arbitrage occurs when an investor can make a profit from simultaneously buying and selling a commodity in two different markets. For example, gold may be traded on both New York and Tokyo stock exchanges.

Arbitrageurs profit at the expense of liquidity providers.

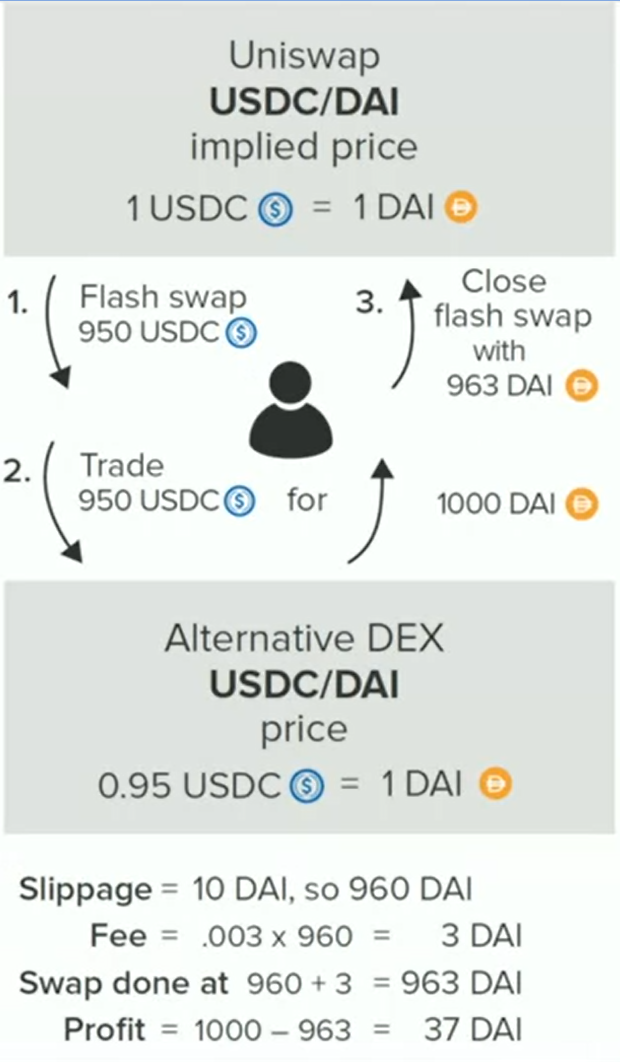

Flash swap

Flash swap sends the tokens before the user pays for them.

It's different from flash loan, whose repayment needs the same asset. Flash swap doesn't. Therefore, it's interesting for arbitrageurs.

For example, we borrow in USDC and pay back in DAI.

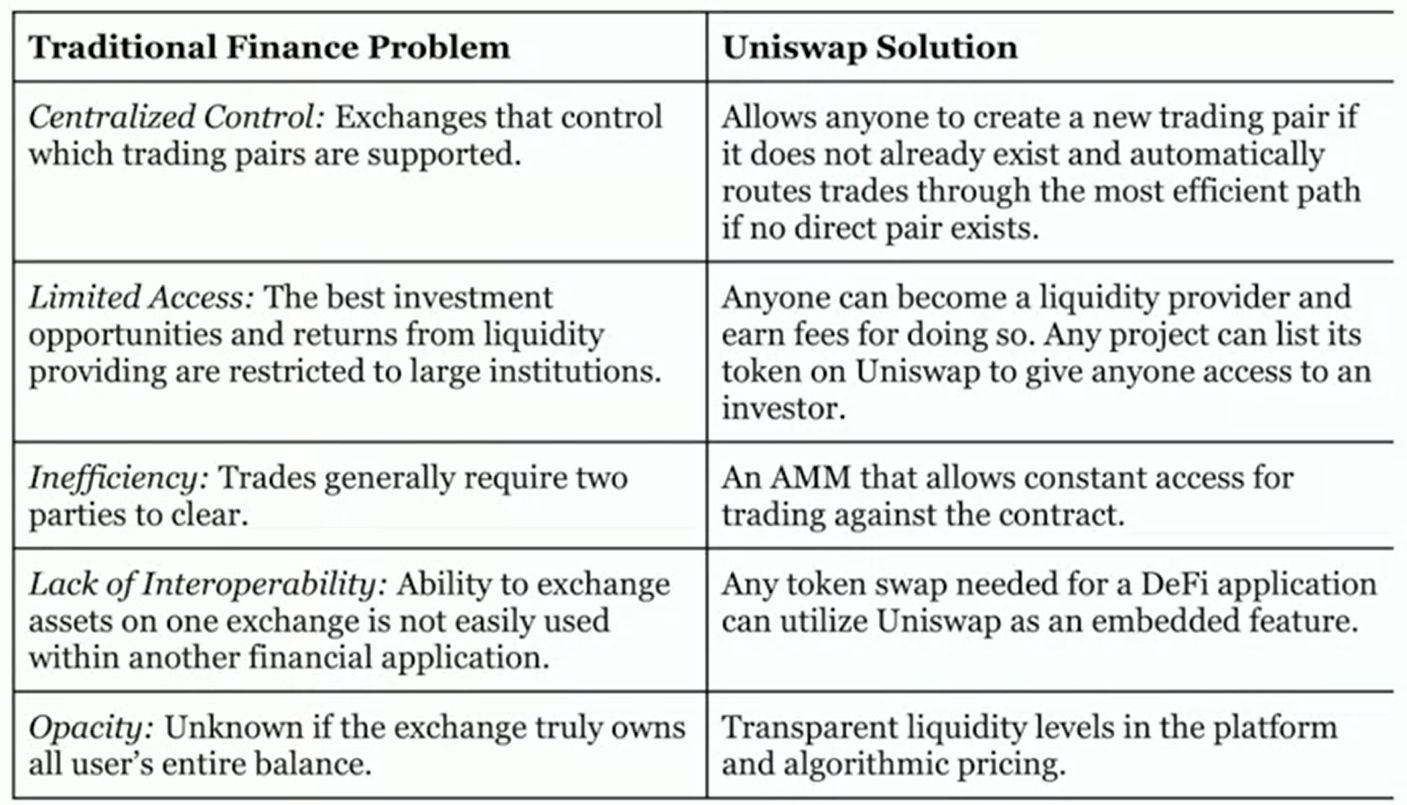

Solution