Synthetix

Synthetix creates the derivative assets whose value is based on underlying assets that are neither owned nor escrowed.

It tracks the assets:

- cypto currency: sBTC, sETH, ...

- fiat currency: sUSD, sEUR, ...

- equity (stock): sFB (facebook), sGOOG (google), ...

- commodity: sXAU (gold), sOIL, ...

Synthetix token

A long Synth is called sToken. e.g. sOIL.

A short Synth is called iToken. e.g. iOIL.

Synthetix platform token (SNX)

SNX is the untility token. It serves as the unique collateral asset for the entire system.

Mechanics

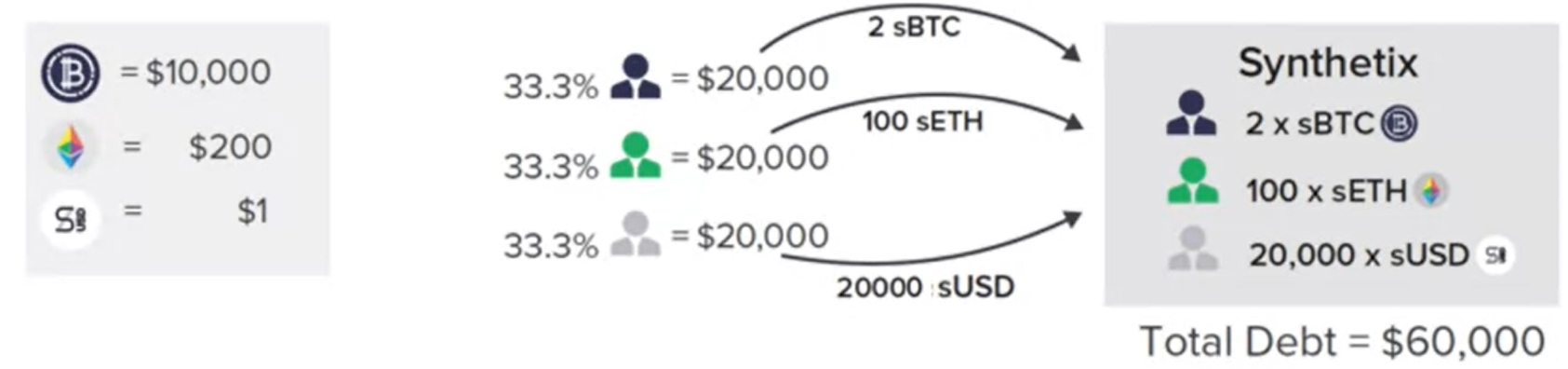

For example, there are 3 traders have $20,000.

- One holds 2 sBTC.

- One holds 100 sETH.

- One holds 20,000 sUSD.

The total debt is $60,000. Each of them has 33% of the share of the entire pool.

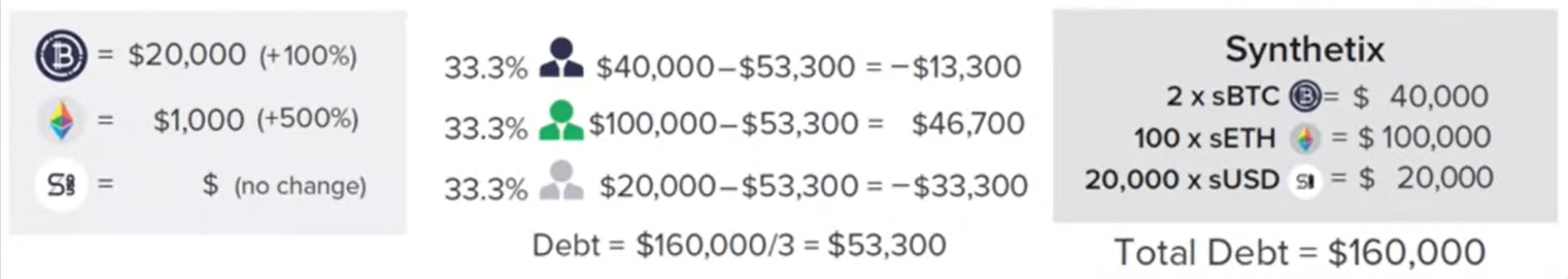

If BTC goes up 100% and ETH goes up 500%.

The total debt is $160,000. Each of them has $160,000 / 3 = $53,300.

Therefore, only sETH holder wins.

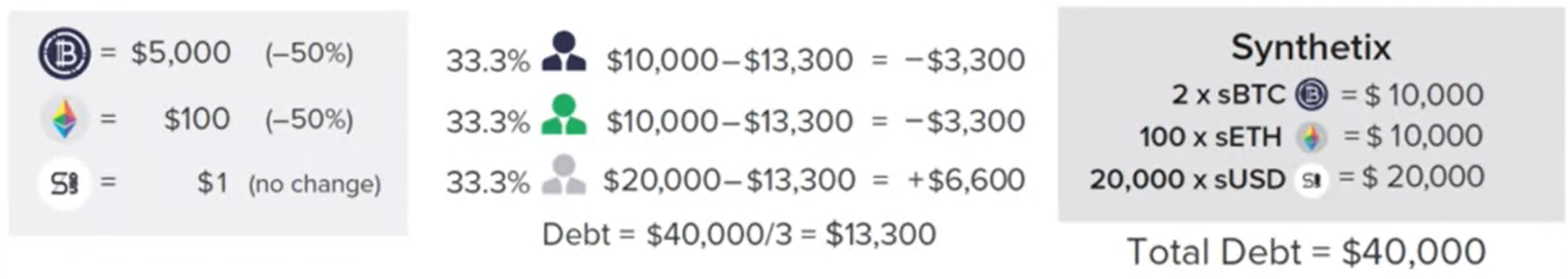

If BTC goes down 50% and ETH goes down 50%.

The total debt is $40,000. Each of them has $40,000 / 3 = $13,300.

In this case, sUSD holder wins.

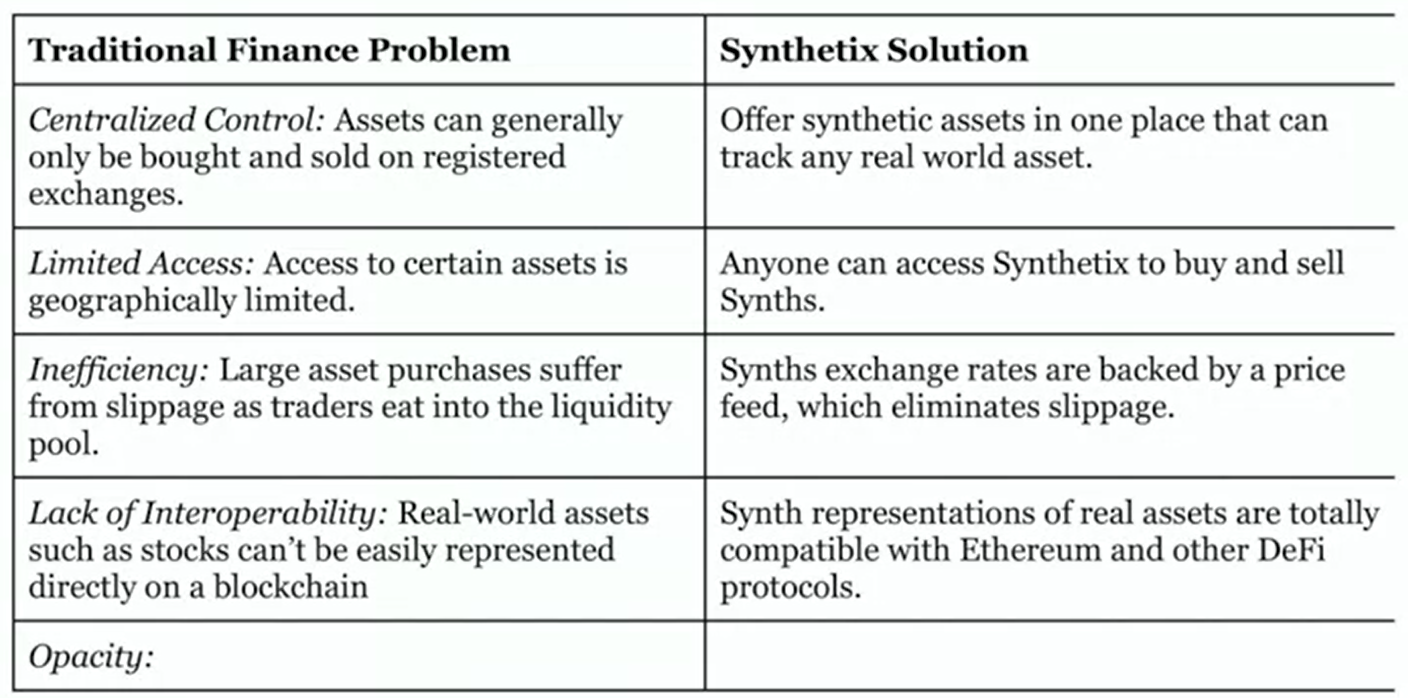

Solution