dYdX

dYdX is a company that specializes in margin trading and derivatives.

The DEX use hybrid on-off chain approach. It keeps signed of pre-approved order without submitting to Ethereum.

Therefore, the orders are used to exchange fund for the desired asset at the desired price. The DEX supports limited orders and maximum slippage parameters for market orders.

Flash loans

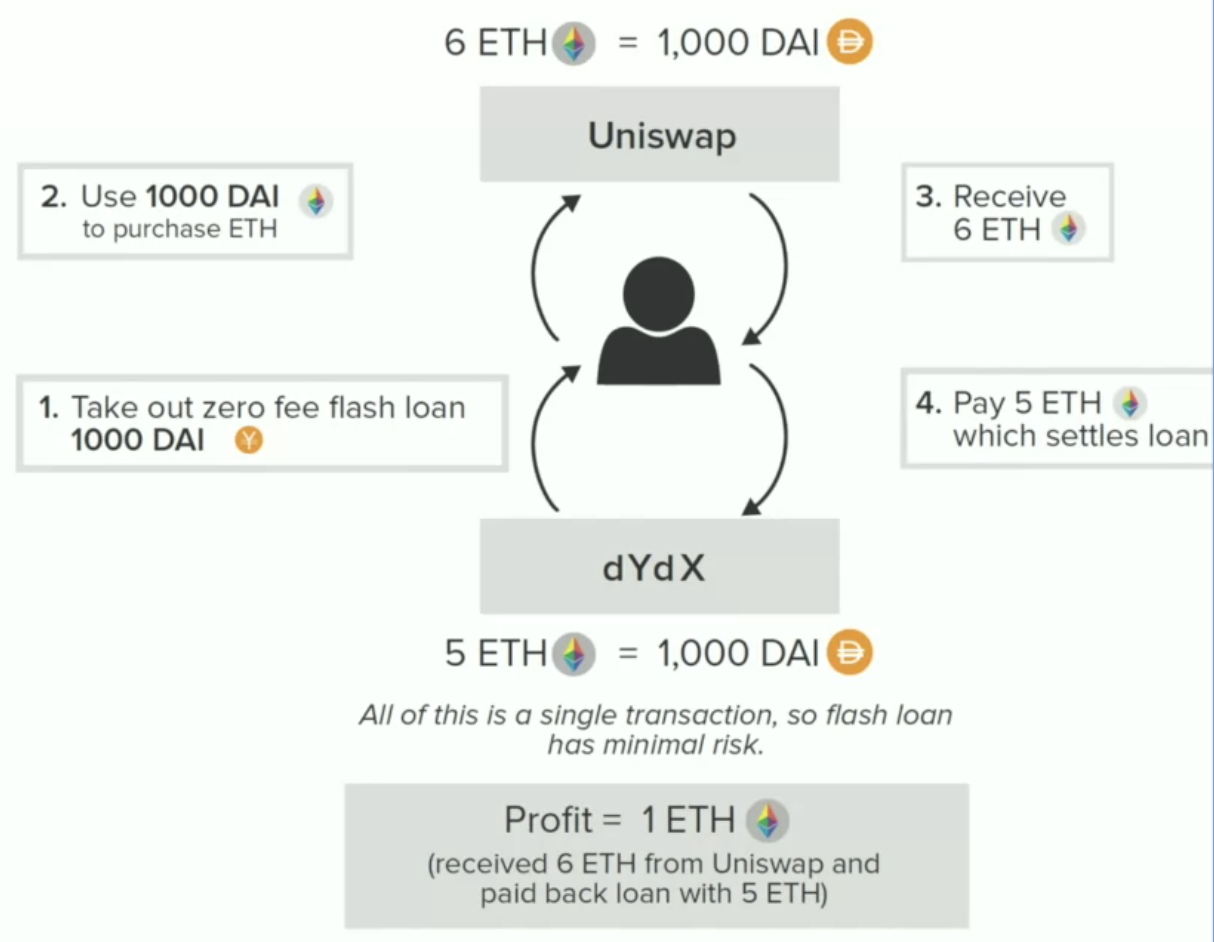

Flash loans are free in dYdX.

Flash loans are very important for arbitrage. For example:

Perpetual Futures

Perpetual futures are similar to traditional futures but without a settlement date. The investors is simply betting on the future picture of the asset.

The contract can be long or short, with or without leverage.

If the collateral is below the margin (e.g. 10% of asset), keeps come in and liquidate us (take all the rest of our money).

Traditional futures

Future is to buy/sell(long/short) the asset in future.

For example, we want to make a long future. We don't have enough money to buy an asset. So we deposit 10% of the collateral to buy the long future.

If the price goes up in the future, we win. If it goes down, we lose. If it goes down more than 10%, we are liquidated.

Future funding rate

Future funding rate keeps the future price to the index. It lets one side pay another.

-

Trading at premium:

Future funding rate is positive. Long pays short.

-

Trading at discount:

Future funding rate is negative. Short pays long.

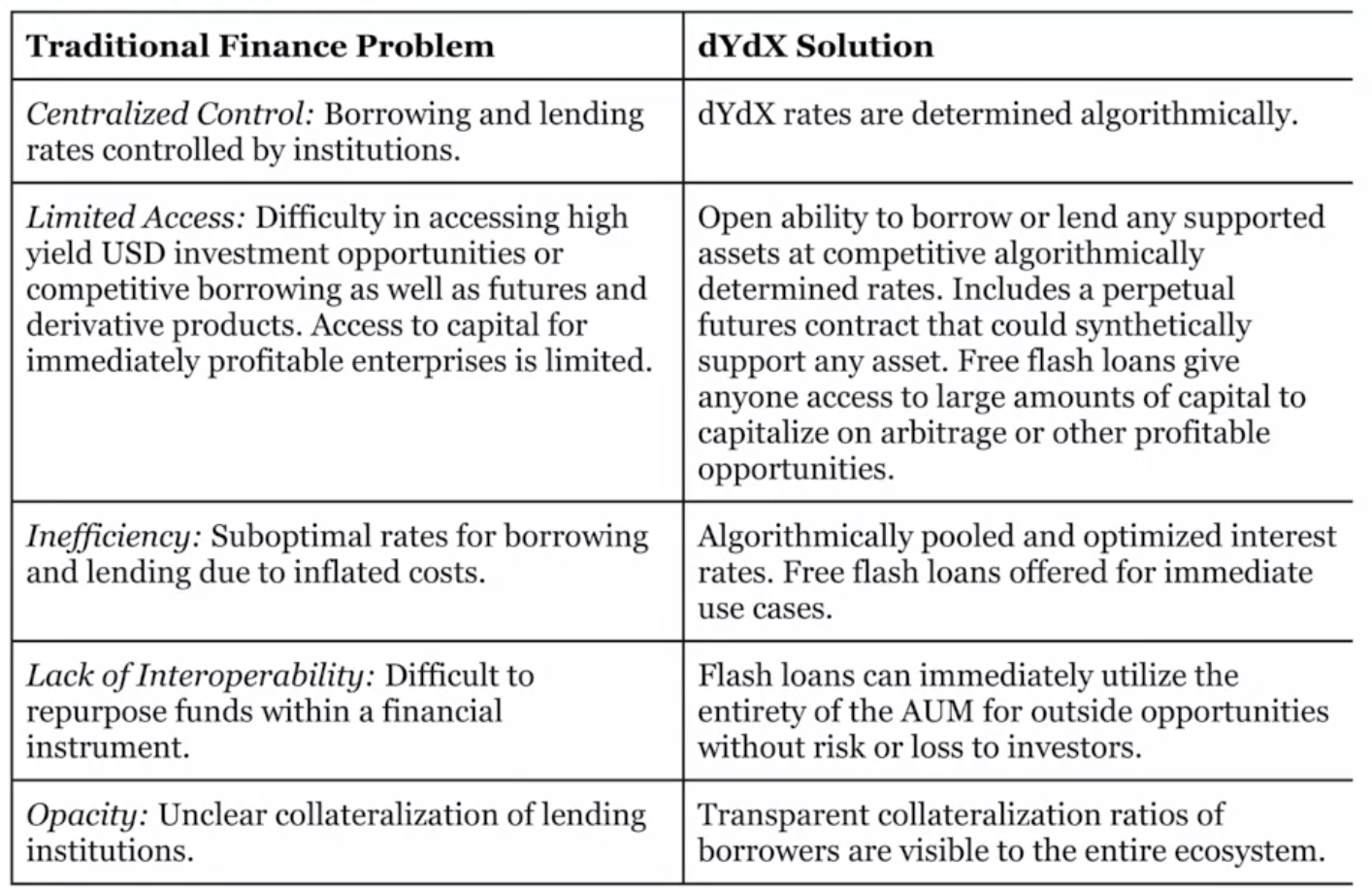

Solution