Compound

Compound offers different ERC-20 tokens.

All the tokens are pooled together, so that every lender earns the same variable rate and all the borrower pays the same variable rate.

Overcollateralization

Since the ETH and ERC-20 tokens are not stable. They are overcollateralized as what we do in MakerDAO.

Collateralization ratios and factor

Different token has different collateralization factor in compound. And:

Ratio = 100 / factor

Volatile assets generally have lower collateral ratio.

Therefore, the power of compound is to mix the assets with different volatilities to get the max total borrow liquidity. For example, 80% of ETH (factor is 60) and 20% of DAI (factor is 90).

Supply and Borrow

The supply and borrow interest rates

- are compounded every block

- are determined by the utilization percentage in the market

The utilization percentage is total borrow/total supply. It's one the parameters that determines the interest rates. Others are set by Compound Governance.

Borrow interest rate

rate = slop * x + base rate

- slop: It represents the rate of change of the rate.

Supply interest rate

rate = borrow interest rate * utilization ratio

cToken

cToken represents the share of pool after you deposit your assets in a pool.

cToken is collateralized by the pool. It's valuable. It can be traded.

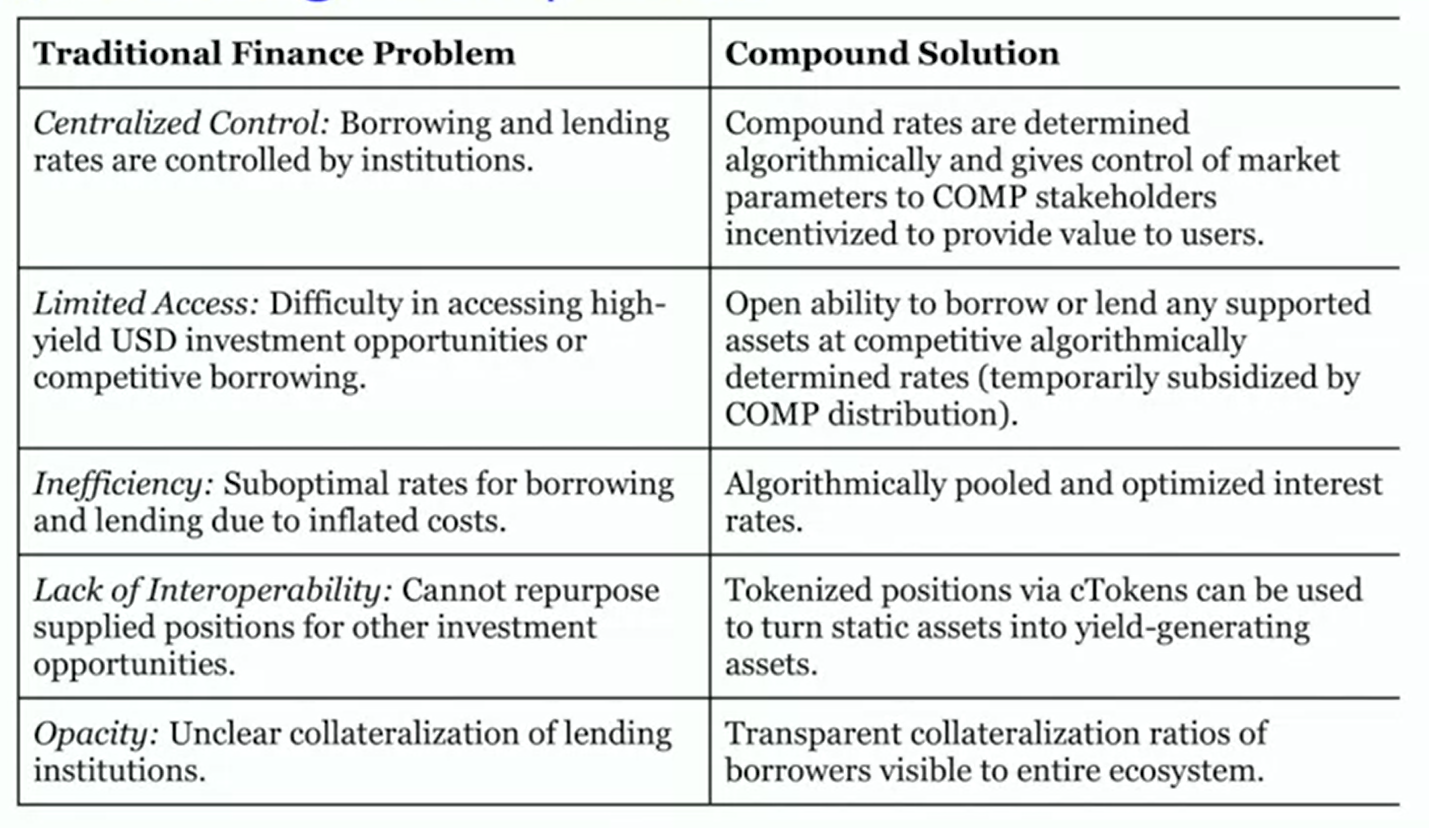

Solution